Awe-Inspiring Examples Of Info About How To Keep Track Of Mileage

The current crop of mileage apps eliminate most of the time spent tracking, logging, calculating, reporting, and approving employee business.

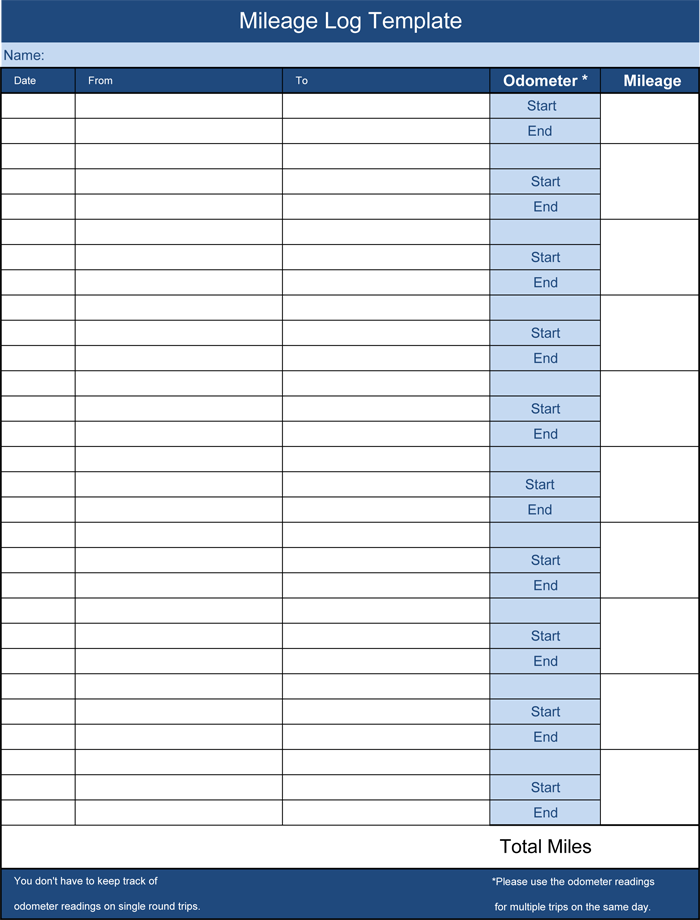

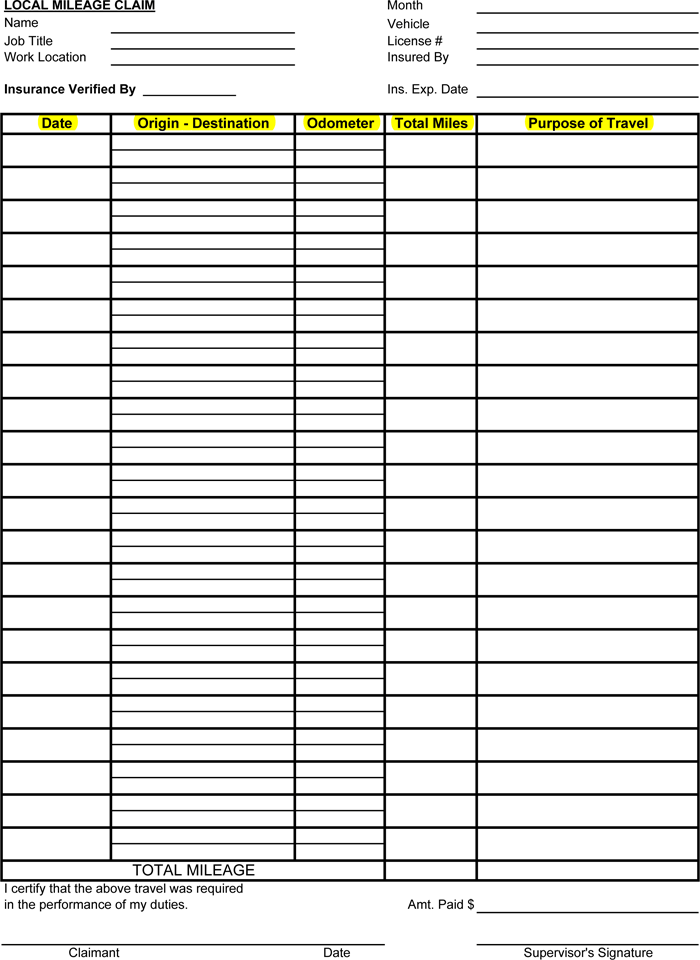

How to keep track of mileage. An odometer is an instrument attached to your. Keep your log on paper and pay with your time (for beginners only!) keep your log with free or cheap software and pay the irs fine. 4 benefits of mileage tracking apps like mlog.

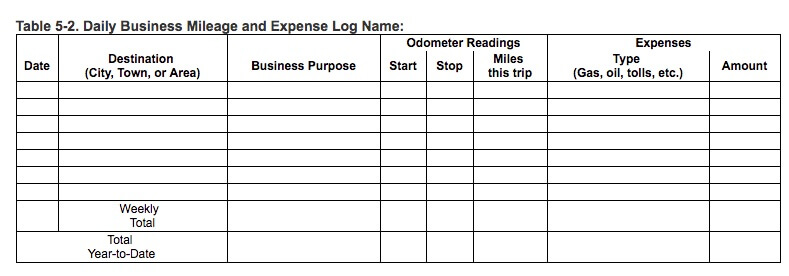

There are several benefits to opting for this tactic instead of tracking mileage manually. Once you flag certain routes,. Tips for keeping track of mileage.

With the mileagewise app you can track your miles via vehicle movement tracking, a plug’n’go setup, or even bluetooth tracking. How to track your business vehicle’s miles as accurately as possible: We are one of few if not.

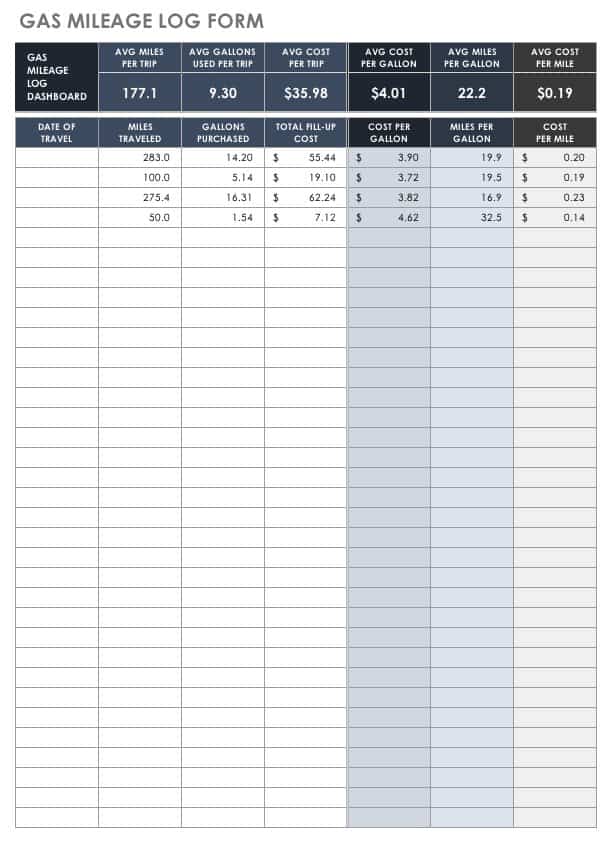

Altogether, there are 3 automatic and 1 manual recording modes you can track your miles with on the mileage logging market: Record business miles with your taxes in mind. $5.99/month, or $59.99/year (paid annually) features:

This app provides accurate, automatic mileage. There are 3 major methods to do that: Ad for less than $2 a day, save an average of 30 hours per month using quickbooks online.

You will need four pieces of information for every business trip: Trip cubby is a fully featured, yet cleanly designed, application that allows users to keep track of miles put on their car. “on the forecast track, the center.