Fabulous Tips About How To Apply For Homestead Exemption In Ga

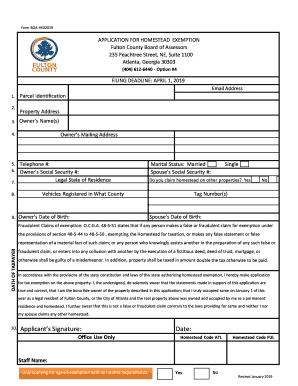

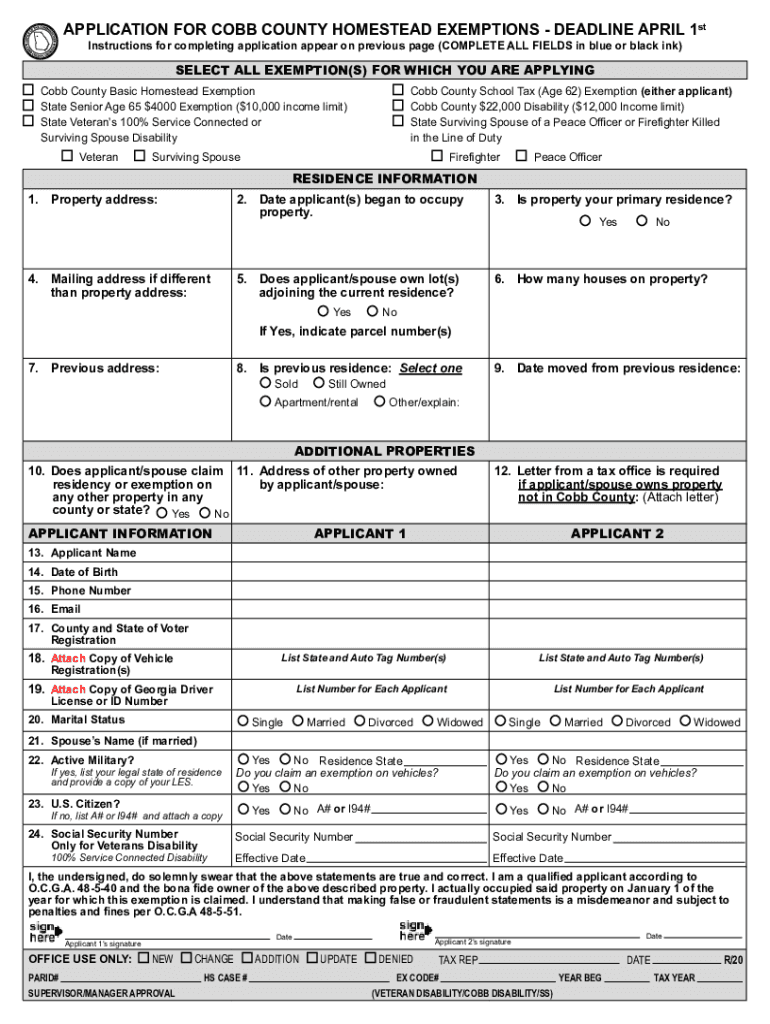

You will need the following items when applying for homestead exemption:

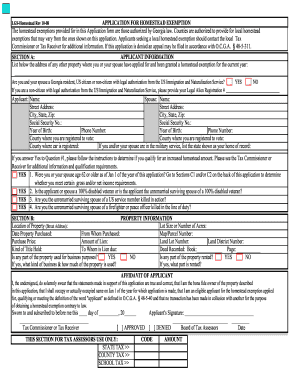

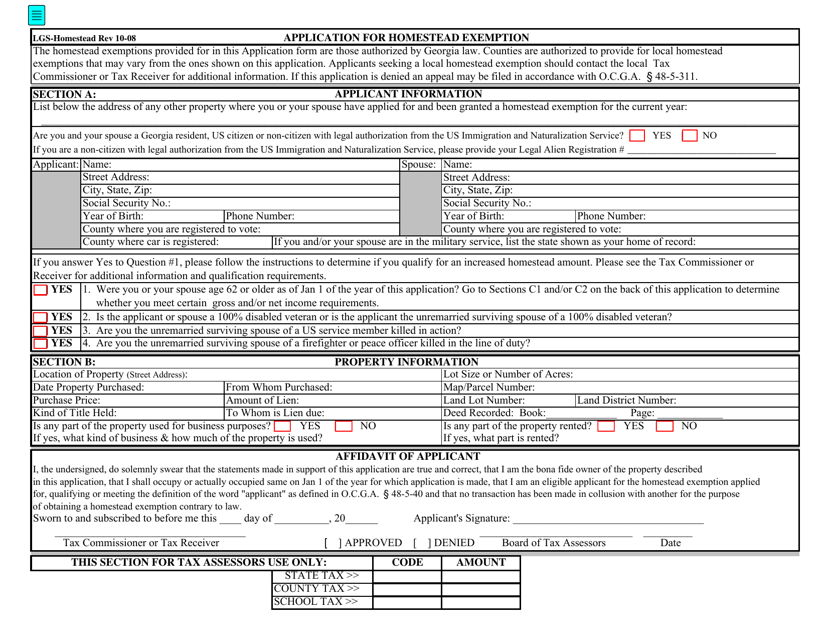

How to apply for homestead exemption in ga. Applications for homestead exemption must be made between april 2 of the preceding year and april 1 of the year in which the exemption is sought. To apply for a homestead exemption, you need to submit an application with your county appraisal district. A) a valid georgia driver’s license or georgia.

Applying for homestead exemptions can be done in just a few simple steps. Application for homestead exemption is made with the tax commissioner in the county. How do i apply for a homestead exemption?

Georgia driver’s license or valid ga identification; 1113 usher street suite 102. Failure to apply by the deadline will result in loss of the exemption for that year.

Homestead exemptions are a form of property tax relief for homeowners. You can complete your homestead exemption application online: Navigate to the qpublic website.

Individuals applying for the first time must own and occupy the home as their primary residence as of january 1, have all vehicles registered in dekalb county, and not have a homestead. If you filed for a homestead exemption with dekalb county, you must also apply with the city of decatur. Social security number (owner and spouse) registration for.

A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on. People owning and occupying property as a permanent residence.